Retirement plan rollovers are a great way to build your financial advisory practice and gain more assets under management.

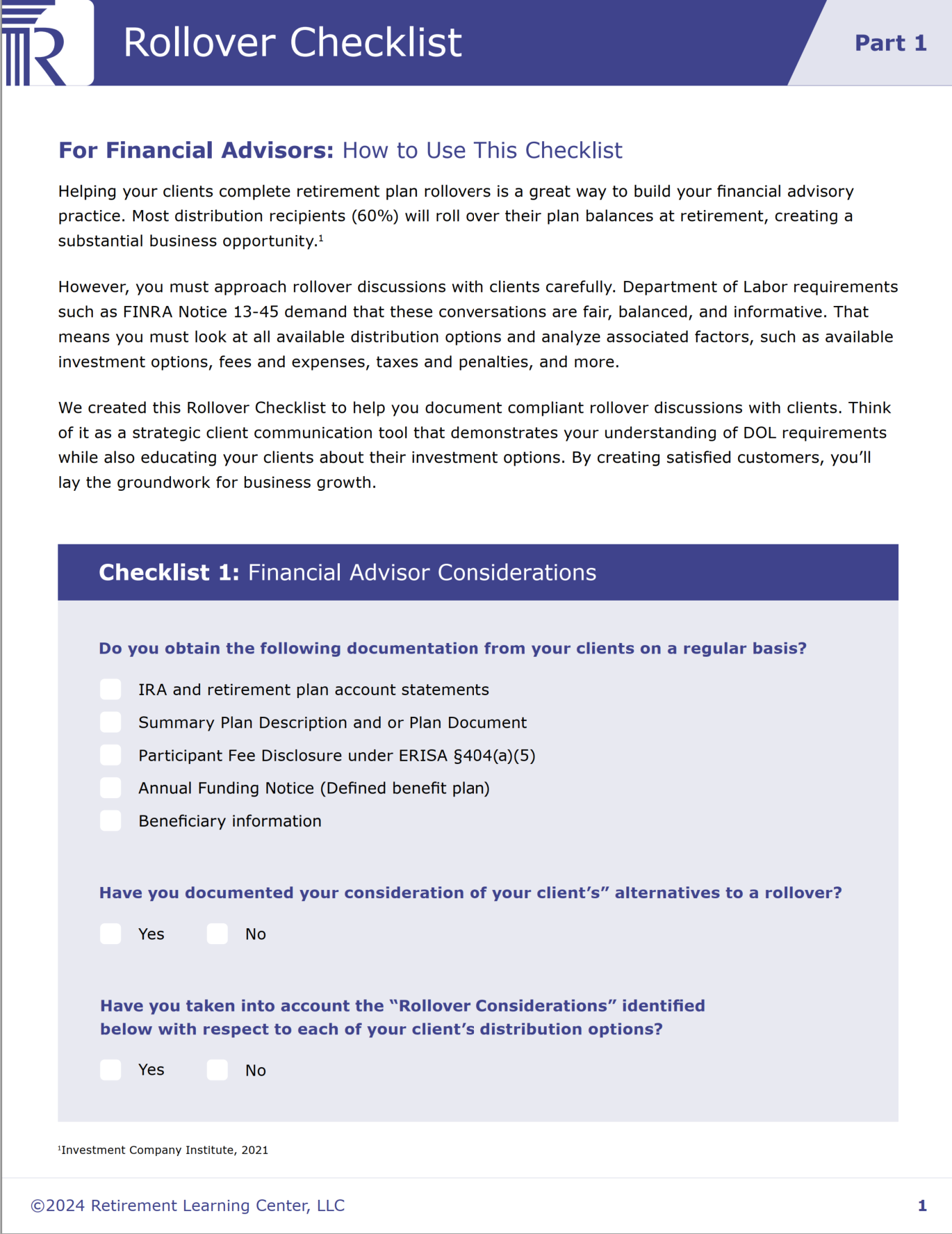

Ensure your client discussions are compliant with DOL requirements

Approximately 60 percent retirees rollover their plan balances upon retirement, creating lucrative opportunities for advisors1

However, DOL requirements such as FINRA Notice 13-45 demand that these conversations are fair, balance, and informative.

1. Investment Company Institute

This checklist will help you to:

Capitalize on opportunities

Learn how retirement plan rollovers can be a strategic avenue for growing your advisory practice, offering a wealth of untapped potential.

Ensure compliance

Our checklist helps you document every conversation in full compliance with the Department of Labor regulations, safeguarding both you and your clients.

Empower client decisions

Guide your clients through their investment options with clarity. Improve your understanding of the Department of Labor's requirements.

For decades, we've provided retirements plan advisors and wealth managers with the tools and support they need to thrive and grow their practice. With our strategic practice growth services and education resources, RLC will help you on the path to success.

Whether you're looking to grow your practice, or yourself, we have you covered. Ready to take the next step?

Sign up for a free 14 day trial and experience the RLC difference.

What is a retirement plan rollover?

A retirement plan rollover refers to the process of transferring funds from one retirement account, such as as 401(K) or a pension plan, to another retirement account, typically an individual retirement account (IRA) or another employer-sponsored plan.

Rollover are opportunities for advisors to help their clients optimize their retirement savings strategy. Areas of optimization for an advisors to consider are:

- Consolidation and simplification

- Access to investment options

- Cost and fee considerations

- Distribution planning

- Estate planning and beneficiary designations

About Retirement Learning Center

At RLC, our expert consultancy offers unbiased guidance, strategic insights and tailored solutions, empowering advisors to navigate the complexities of the retirement planning landscape with confidence.

For more information, visit retirementlc.com